Periodic expenses are expenses that happen infrequently and are hard to plan for such as car. There are three major types of financial expenses.

What Does It Really Mean To Live Within Your Means

You should also include fees for broadband and other money you pay to get online.

Expense categories by percent income. Professional Services Fees paid for professional services employed that are related to your business. Many of us are going to be over that when we take a look at our own Profit Loss. A business expense category is an organized way to group expenses for tax reporting purposes.

82 of revenue goes to expenses and taxes leaving 18 profit. For some businesses travel is essential to provide services obtain training or secure new contracts. To better grasp functional expense allocation it helps to understand why its important for nonprofit organizations in particular to report their expenses by function.

Variable costs are expenses such as utility bills credit card fees and meals. Viele übersetzte Beispielsätze mit expenses by category Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. That includes rent or mortgage payments property taxes HOA dues and home maintenance costs.

Attorneys and legal services. 10 For families with heads ages 6574 housing debt increased from 18 percent in 1992 to 41 percent by 2010. For most budgeters this category.

81 of revenue goes to expenses and taxes leaving 9 profit. Fixed expenses are expenses that dont change for long periods of time like office rent or vehicle lease payments for you or your staff. A common question that arises when itemizing your monthly expenses is what percent of my income should be allocated to each expense category.

When you take a business trip or send your employees to do the same you may be able to claim. Most but not all expenses are deductible from a companys income revenues to arrive at its taxable income. For families with heads age 75 or older housing debt increased from 10 percent to 24 percent.

For example assume you want to save 20000 for a down payment on a home and you have a two-year window to save. Housing transportation food utilities insurance premiums and other essential costs. He has various recommended percentages for various sized businesses but those of us in the smaller blogging digital products and service-based business spaces all likely fall in the.

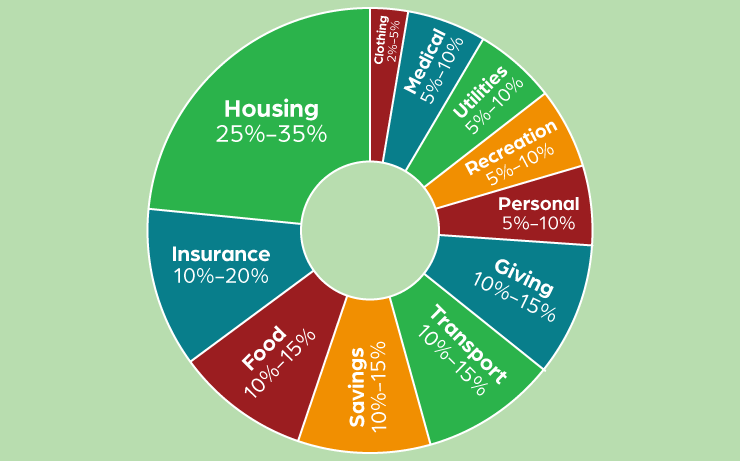

Variable expenses change from month to month such as utilities or meals and entertainment. Your disposable income is what you have available to spend on your home budget categories. Housing 25-35 percent Anything you pay toward keeping a roof over your head is considered a housing expense.

Viele übersetzte Beispielsätze mit category expense Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. While the expense exists with each billing cycle the amount will change from month-to-month. To simplify further for every dollar your company makes five cents will go toward your lease.

Items that are not tax-deductible vary by region and country. The emergency fund doesnt need to be more than 6 months of expenses which is 3 months of income if your expenses are only 50 of your income. Its important to consult a professional tax advisor to learn about what expenses.

Per diem or real expenses for lodging. Fixed Variable and Periodic. I keep 6 months of expenses liquid and another 12 in a low risk investment.

For instance if you pay 100000 a year in rent and your income is 2 million your rent equals 5 percent of your income. Once you have your emergency fund funded you can add that percentage to a different category say 15 to retirement and 10 to planned big purchases or you can over-fund it. Money that you spend on bills like electricity gas water or trash collection.

Based on the sample budget percentages offered earlier thats not too far off the mark from the ideal. Per diem or real expenses for meals and. Instead of providing a master list that includes everything a business can deduct the IRS has defined a business expense.

Look at what youve spent in previous years and determine the percentage. If you work from home you can deduct a percentage of your household bills depending on how much of your home is used for business. That breaks down to 833 per month.

Its important to know what type of expenses are included or not included in a category to apply the appropriate rules when it comes to deducting them on your tax return. Chron suggests expense percentages for other industries. Unfortunately there is no one size fits all answer to this since everyones circumstances are unique - a person may spend a higher percent for rent in New York City but have no car expenses or live in an area where you spend much less for.

83 of revenue goes to expenses and taxes leaving 17 profit. The most common tax-deductible expenses include depreciation and amortization rent salaries benefits and wages marketing advertising and promotion. For families with heads ages 6574 housing debt increased from 44 percent of income in 1992 to 86 percent.

You can claim the amount of expenses that is more than 2 of your adjusted gross income. With this in mind his recommended percentage to be allocated to Operating Expenses is 30. Use this category for your mobile and landline expenses.

Now using that 5000 per month income example earlier saving that amount would represent roughly 165 of your income. In contrast Social Security private and government retirement benefits made up 103 percent of the pretax income of the 5564 years group. Functional expense allocation is the process by which a nonprofit organizations accountant or bookkeeper classifies each expense by its functional classification.

Popular Posts

-

Follow Work Senior Software Engineer at Cloudera. Remove the cues of your bad habits from your environment. Atomic Habits Cheat Sheet Reb...

-

Eric Barker who recounts this study also notes in The Week that the two-question technique could be successfully employed to make people li...

-

The main purpose is to rid your spaces and life of unnecessary stuff. Download Minimalist One Bedroom Apartment Interior Design PicturesOur...

Featured Post

queen elizabeth largest diamond

The Queen owns the world’s biggest diamond and it’s worth millions . Web THE Queen has an impressive jewellery collection filled with...

ads